There is No Such Thing as a Free Lunch

The fast-moving world of finance constantly evolves, so being open-minded to new ways of doing things is important. However, just as importantly, we must always keep in mind some things that don’t change very much. Whether we admit it or not, people’s behavior is one of those things. Human nature just does not change a whole lot throughout history. We may have more information than ever before, but the same psychological biases and emotions that have influenced people’s investment decisions in the past will continue to do so today and in the future.

For this reason, the concept that “there is no such thing as a free lunch” is an important one to remember as an investor. It is a helpful reminder when our natural inclination to get something for nothing kicks in. In investing, just like in life, there are no guarantees. Despite whatever the latest financially engineered product or “can’t miss” investment of the moment is, we must never forget this fact. Everything has costs. We know this intuitively, but we usually have to learn (and relearn) it the hard way. Our brains are hard-wired to combat uncertainty and seek safety. Markets can often feel the exact opposite of those things. For this reason, Wall Street loves to tell you they know what is going to happen next. It is also why they sell products that promise safety, smooth returns, and protection from selloffs. The human brain instinctively craves a feeling of control and predictability in times of stress, and Wall Street knows it. Unfortunately, while the notion of a “free lunch” is a great sales tactic, there is no risk-free way to achieve one’s financial goals. The costs to any “free lunch” are always there, they are often just hidden.

The false sense of security that comes from avoiding the ups and downs of the markets can lead to huge mistakes and opportunity costs. Understanding that volatility and risk can never be fully removed is essential to making sound investment decisions. They are the cost of admission to experience the long-term benefits investing can provide. Now, let’s define what these two things are. While modern portfolio theory defines risk and volatility as the same thing, they are not.

Risk refers to the uncertainty or potential for loss in an investment. It encompasses a range of factors such as market fluctuations, interest rates, liquidity, economic conditions, industry trends, specific company risks, currencies, and credit. Volatility, on the other hand, is a statistical measure of the degree of fluctuation in the price or value of a financial instrument over time. It quantifies the speed and magnitude of price changes.

Let’s simplify this in English: Risk is the chance you will lose money permanently, while volatility is the size of the swings up and down in the short-term. Volatility is only one component of risk. They are obviously related, but it is an important distinction. Here is why:

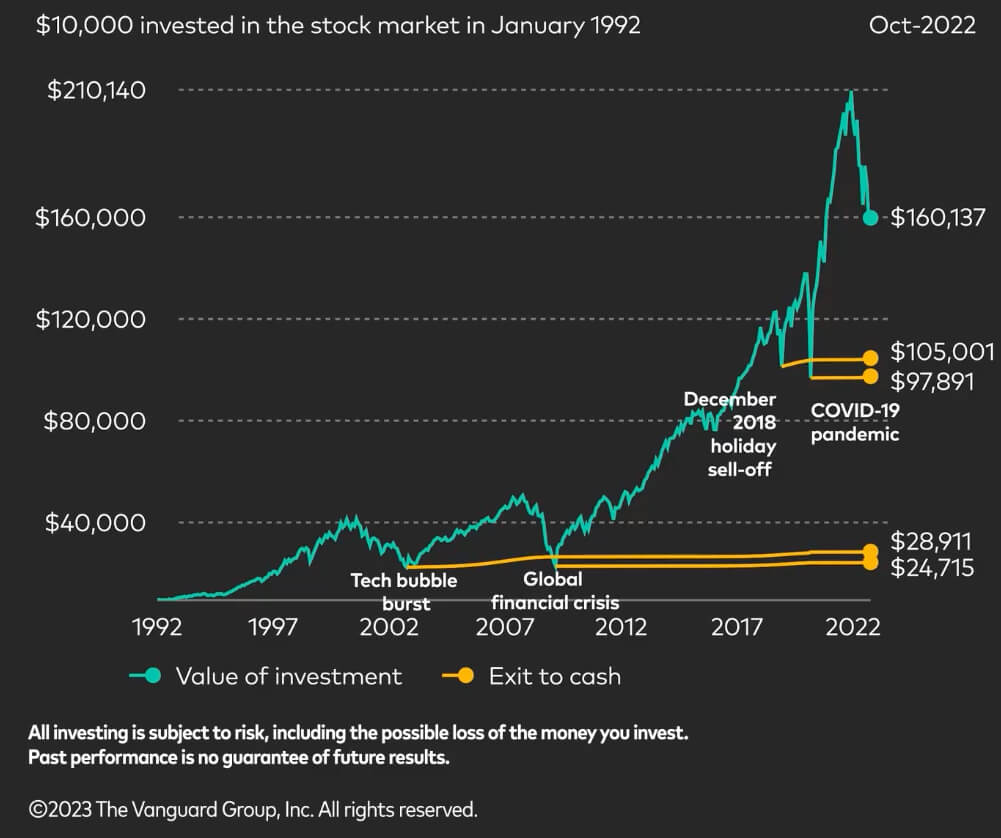

Withstanding market volatility is the price you pay in the short term to enjoy growth over the long term. While it makes us uncomfortable, history shows trying to avoid it is a mistake. The below chart shows what $10,000 would have grown to if you invested it in the stock market in 1992. The yellow lines represent what that money would have turned into if you sold out and went to cash at various times when the markets were volatile, and things were uncertain.

You could go back farther, and this same concept would hold true: ironically, moving to cash has been much riskier than withstanding volatility. Following the crowd or playing it too safe can lead to huge mistakes. History has shown that it has been the surest way to lose money during a selloff. In other words, human instincts can lead us to buy and sell at the exact opposite moments that we should. Obviously, this does not mean you can throw everything you have in the stock market and call it a day. Being strategic and understanding your own situation and goals must be step one. Matching up the risk you are taking and your time horizon is essential. Given that the whole concept of this article is that there are no guarantees, we should also mention that past performance is not a guarantee of future results.

Rather than trying to find ways to avoid the volatility that comes with markets, we need to play a different game. Instead, you can set up your household balance sheet in a way that insulates you from short-term swings and allows you to take advantage of the long-term gains. The bottom line is this: there is no way to participate in the upside of markets without being willing to experience the downsides that come with it along the way. We must accept the fact that when it comes to investing (and life), we cannot get something for nothing. There is no such thing as a free lunch.

————————————-

You Cannot Time The Market

In Part I of our Foundations of Investing Series, we highlighted how there are no special investment products or processes that are bulletproof. It requires discipline and sacrifices. We are going to build on that in Part II as we discuss market timing. The market is very unpredictable contrary to what you may see on TV. The talking heads make it sound like it is a piece of cake to sell, sit on the sidelines and get back in at the perfect time. The reality is that anyone promoting this approach is oversimplifying things in a way that is not helpful for the vast majority of investors.

There are times when it gets very tempting to listen to the voices around you telling you they know where the market is going next. This is where the discipline really needs to kick in because in order to successfully time the market, you have to be right twice. Let’s say you go with a gut feeling and liquidate your entire portfolio at or near a market peak. You feel pretty good about yourself as stocks fall and crisis sets in. That is until you start to feel the pressure of when to get back in. Those that have lived through the bad times know that the market usually turns around right when you’re ready to throw in the towel. By the time you have the courage to get back in, you likely missed a significant part of the recovery. All the experts with their predictions calling it a “dead cat bounce” or a “bear market rally” leave you reluctant to pull the trigger. That leads to the mental warfare of wondering if their forecasts will come to fruition right when you finally push the button to get back in. Suddenly, the smartest move of your life turns into a very stressful situation.

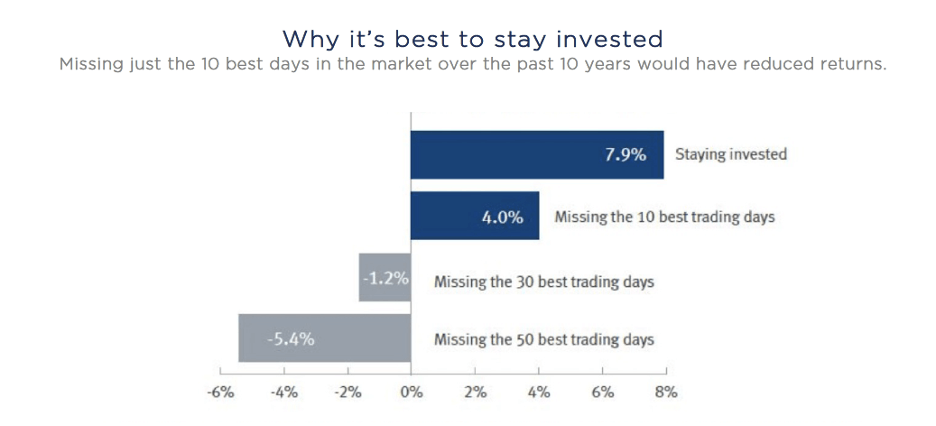

Markets can appear to be irrational in either direction for extended periods of time making it incredibly difficult to be right twice. The more optimal thought process, although it will certainly have some gut checks, is to forget about timing the market. Instead, think about how much time you have in the market. The more time you have in the market, the higher the likelihood of success. That’s why most asset allocators will recommend more equity exposure to those with longer time horizons. The chart below highlights the impact on returns when you miss the top trading days over extended time periods. Missing the 10 best trading days in the 10 year period cost 3.9% annually over 10 years. That is a remarkable statistic. To take it a step further, those big trading days often occur after significant drawdowns.

Nobody knows where the market is going at any given time. All the predictions are educated guesses and are usually wrong. Some make it sound so easy and that is where the temptation can set in. Utilizing a bucket approach to managing your money helps limit that temptation. It is a little easier to leave your long-term money alone knowing that your shorter-term money is safe if you need it. If you want to have some play money, have at it. Take a few dollars that don’t matter to you and try to play the market. For your more serious money, you’ll be much better off making a plan and sticking to it. While it won’t be as exciting, the slow and steady, diversified approach should prevail in the long run. You cannot time the market.

——————————

Know What You Own and Why You Own It

In Part I and Part II, we focused on things that should be actively avoided to achieve success as an investor. For Part III, we are discussing something we need to actively do. “Know what you own and why you own it” is a simple concept, but the practice of it is often missing in action, whether it is someone opening their first investment account or the most sophisticated people on Wall Street aiming to beat the market.

This phrase was made famous by legendary investor Peter Lynch, who managed the Fidelity Magellan Fund and is considered one of the greatest investors of all time. The genius of Lynch’s investing philosophy lies in its simplicity. He even wrote a best-selling book about how it could be applied. The most important aspect of his philosophy is this idea that you should know what you own and WHY you own it. In other words, investors need to have an understanding of what is in their portfolio, why it is there, and how it will behave in different scenarios. In Lynch’s view:

“If you can’t explain to a 10-year-old in two minutes or less why you own a stock, you shouldn’t own it… Stocks aren’t lottery tickets. Behind every stock is a company. If the company does well, over time the stocks do well, and vice versa. You have to look at the company—that’s what you research.”

Here is the thing though, this concept is not just for professional money managers and it doesn’t just apply to individual stocks. If you own mutual funds or ETFs, do you generally know what the underlying assets within these investments are? Do you know what they cost? Have you defined the overarching goal(s) for your various accounts? Given this added context, we believe it is essential for everyone aiming to create, build, and preserve wealth to know what they own and why they own it. Here is why:

- It provides a sense of organization and clarity of purpose.

Investing success boils down to identifying your individual goals and then matching the risk you take with the time horizon in which you may need the money. Put more simply, it comes down to understanding what you are trying to accomplish, how you are trying to accomplish it, and where you are trying to accomplish it. We need to be able to invest for our goals in the short-term, the long-term, and everything in between at the same time. Therefore, we should be giving specific “assignments” to specific parts of our investment portfolios. Different accounts should have different goals and timelines, and thus different investment strategies will be appropriate. If you are building a “rainy day fund” you may need sometime next month, it probably shouldn’t be invested in stocks. If you are saving money you don’t expect to touch for years, cash is probably not the best option.

Regardless of how much money you have or what stage in life you are in, this process of assigning different goals to different “buckets” helps your money compound while avoiding mistakes. It also ensures you manage your expectations appropriately while understanding what you are paying along the way. Understanding at a high-level where you will spend money from first in retirement, or where you should invest most aggressively helps alleviate confusion and anxiety. Most importantly, it becomes much easier to make informed financial decisions and provides clarity so you can align your assets with your overall goals and values.

- It helps you stay focused on the things that matter.

To be clear, this is not to say people need to understand the nuances and details of each specific investment like Peter Lynch, or that you should spend hours doing research on stocks and watching the financial news. In fact, it should mean just the opposite. For example, should a 30-year-old dollar cost averaging into a retirement account with index funds care about what the stock market is doing today if they know their investment horizon for that account is 30 years from now? Should a retiree lose sleep about the potential for a recession this year if they know they have a few years of spending properly allocated and available to them? If you understand what you are trying to accomplish and what you own to help you accomplish it, you can think less about money and more about the things that really matter to you.

A good financial strategy should be designed to give you the best possible chance to accomplish your specific goals. Everything else is noise. Trying to beat the market or outperform some arbitrary benchmark can just make things more stressful and confusing. As Ben Carlson wrote in a recent article “Real risk for investors has nothing to do with underperformance or black swans or recessions or market crashes or any of that stuff we obsess about all the time. The real risk is that you don’t reach your financial goals. I’ve never met a single successfully retired person who got to that point by paying attention to alpha or Sharpe ratios.” Most people would rather know they are putting themselves in a position to be financially confident about the future so they can live the life they want. Know what you own and why you own it.