Investing & retirement letter by Kirk Spano: MarketWatch, Seeking Alpha and syndicated investment analyst and financial advisor

Clean energy and battery storage have gotten a lot of bad press in the past year despite compound annual growth rates that still lead most other industries. As fossil fuels become more expensive to produce, and climate change becomes a more accepted threat, investors should expect an another massive wave of investment into clean energy and batteries.

Under the most bullish scenarios—factoring in electrification acceleration, renewable integration from the grid to homes, more battery powered devices, a resurgence of EVs and second-life repurposing—the global battery market could reach $1 trillion per year by 2035, with upside potential toward $1.2 trillion at the peak of the storage supercycle, with estimated annual growth rates of 14-18%.

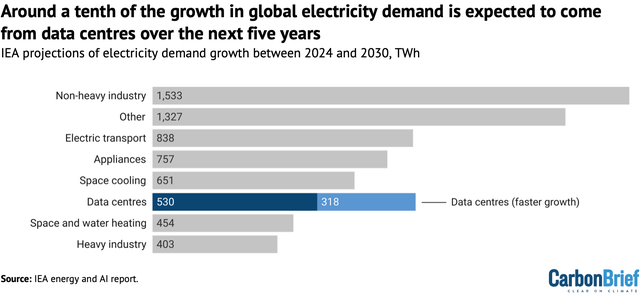

From purely geopolitical and energy security perspectives, clean energy and battery storage needs to grow substantially in the next decade. Energy demand is growing, after a rather flat decade pre-Covid, and AI data centers are a new additive at around 10% of the coming increase in energy needs.

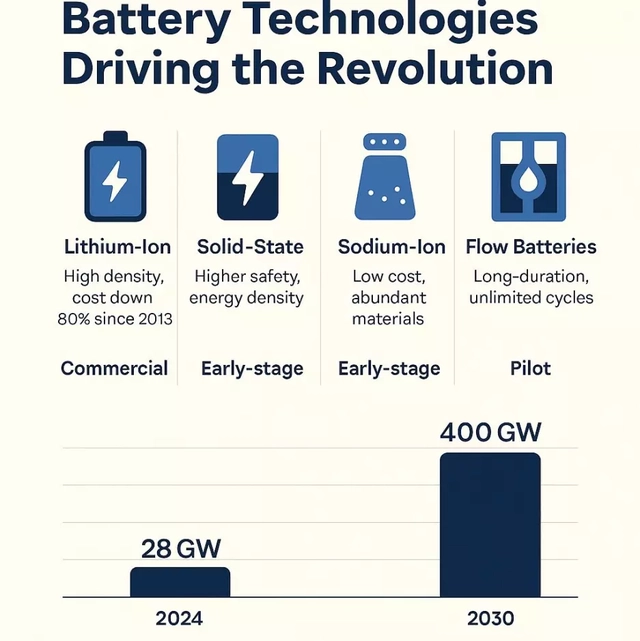

By 2030, global energy storage capacity is projected to soar. It will increase from 28 GW in 2024 to over 400 GW. Batteries are the necessary component of increasing energy demand. Safe and efficient batteries are going to be key to energy security and sustainability.

Lithium-ion Battery Demand

Lithium-ion batteries currently make up roughly 95% of stationary battery storage, i.e. grid scale, and 15% of total installed capacity – but rising quickly.

Grid-scale storage is the fastest growing component of growing energy needs as it allows intermittent resources to power homes and industries at any time of day. Batteries for a growing array of devices and EVs are also experiencing double digit growth rates.

Lithium-ion batteries are well positioned for grid scale storage as rapid discharge rates are optimal for balancing the grid in short durations. But, they are not alone as potential battery sources.

Flow batteries stand as potential partners for grid scale in the next decade as they provide the longer term energy storage at cheaper costs than lithium-ion. Utilities are already in the process of pairing flow batteries with lithium-ion batteries to cover both long-term storage and rapid discharge.

Lithium-ion batteries are used in virtually all devices and EVs.

Aggressive projections place lithium-ion growth rates as high as 23% per year over the next decade. More conservative estimates are in the teen percentages.

With lithium-ion currently dominating growth in multiple markets, growth rates are massive in dollar terms. By 2035, estimates for the lithium-ion battery market range from $377 billion to $798 billion per year.

Battery makers of safe and efficient batteries can see huge growth over the next decade. Companies starting from smaller bases could see the biggest percentage gains in scale and in some cases for shareholders.

The Lithium-ion Fire Problem

The problem of lithium batteries is that thermal runaway, an uncontrolled and self-heating reaction inside a lithium-ion cell can cause the electrolyte to vent and ignite, leading to fire or even explosion.

We recently saw news of the M/V Morning Midas with a shipment of EVs from Asia catch fire in the Pacific. After several days of burning, and abandoning the ship, the vessel was allowed to sink to the bottom of the sea.

We have also heard of Tesla’s (TSLA) and other EVs catching fire, as well as, some stationary lithium-ion batteries. We’ve all felt how hot a cell phone or other devices with a lithium-ion battery can get.

A solution for this problem has been a goal for companies for years. While many battery investors focus on the chemistry of batteries, the real breakthrough appears to have been in the architecture.

Lithium batteries generally follow a wound or coiled “jelly-roll” design using a graphite-based design. A newer, highly patented design, using a stacked 3D architecture with an active silicon anode and a built‑in mechanical constraint plus an intra‑cell current‑limiting safety system called “BrakeFlow” almost totally eliminates fire risk. This is a massive safety upgrade.

Interestingly, the architecture is so far as the company knows, is chemistry agnostic, meaning, if a better chemistry is found than a silicon anode, the battery can be improved. The company that has introduced this technology is Enovix (ENVX).

Enovix Executive Summary

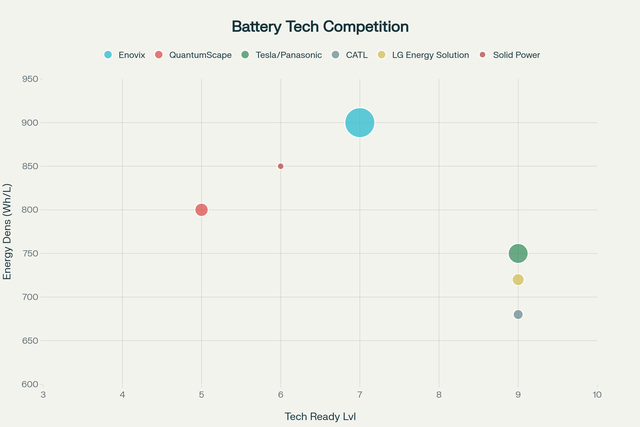

Enovix Corporation is a new core holding of mine that is at the compelling inflection point of exponential growth in energy-dense battery demand and the technological limitations of conventional lithium-ion chemistry. Their elimination of fire risk would typically be enough if the energy density were similar to other batteries, but, their energy density is notably better than competitors.

Key points:

- Revolutionary Technology Platform: Enovix’s AI-1 (trademark) battery platform delivers >900 Wh/L energy density, representing a 30%+ capacity advantage over current premium smartphone batteries.

- Strategic Market Positioning: Focused on high-margin applications including AI-enabled smartphones, IoT devices, and premium electronics where performance commands premium pricing.

- Production Scale-Up: Malaysia Fab2 facility is now operational with ISO 9001:2015 certification, targeting high-volume production by late 2025. They are expanding to four lines.

- Strong IP Portfolio: Protected by 450+ patents covering silicon-anode architecture and manufacturing processes.

- Customer Validation: Secured development agreements with two top-5 smartphone OEMs for Q4 2025 commercial deployment. We are awaiting contracts following design validation.

- Malaysia Pioneer Status gives Enovix 15 years of significant tax exemptions, including a 15-year income tax holiday for meeting certain conditions on employment and investment which they are on pace to easily exceed.

Their Q2 2025 revenue reached $7.5 million, representing 98% year-over-year growth, with the company achieving three consecutive quarters of positive gross margins.

The enterprise maintains $430 million in cash reserves, which is a combination of previous cash on hand and the proceeds of a recent warrant exercise. This cash cushion provides a long runway for its commercialization phase and Chairman T.J. Rogers has mentioned a potential strategic acquisition in a recent call.

I believe that Enovix, which has relationships with EV manufacturers, is in position to license its technology globally and collect royalties without having to expend capex around the globe, as auto manufacturers are already doing it. If the EV market takes off again in a few years, which I believe it has to due to oil constraints and climate change concerns, then Enovix stands to make billions in profits from that one industry.

I like everything the company is doing and believe we are getting its stock on deep discount due to narratives by short-sellers to create FUD. I think the potential EV business is actually given no value, that is, the rest of the company is discounted, but the potential EV business is free in my opinion.

Enovix SWOT

Strengths: Enovix’s core edge is a proprietary 3D cell architecture that enables a 100% active silicon anode which dramatically reduces lithium-ion battery fire risk. The company’s AI‑1 platform targets next‑generation mobile devices with demonstrated energy density above 900 Wh/L, fast charging at 3C rates, and smartphone‑relevant cycle life in the 900–1,000+ range, directly solving the power budget constraints of AI‑class devices. Their technology is heavily patented creating a moat around the business.

Their Malaysia Fab2 site has been built for high‑volume production after meeting quality audits. Lines 3 & 4 should be operational in the H2 2026. Enovix began sampling EX‑1M and EX‑2M from Fab2 and has moved closer to contracts, which, in my opinion, seem imminent. Recent capacity and footprint additions include the April 2025 acquisition of SolarEdge assets in South Korea to support defense demand and pack assembly.

Enovix is prioritizing high‑value applications where performance commands premium pricing, led by smartphones and computing devices, with a vertical go‑to‑market model focused on a smaller set of large OEMs and custom cell designs. The company has executed development agreements with leading smartphone OEMs targeting late‑2025 commercialization (imminent potential contracts) and has expanded sampling and factory audits to support qualification milestones. Diversification spans IoT, XR/AR wearables, defense, and longer‑dated EV opportunities via collaborations and licensing, broadening the addressable market while managing capital intensity and scale‑up risk.

Weaknesses: Enovix has advanced its factory buildout and certifications but has yet to demonstrate sustained, high‑volume output at the levels required for major OEM supply, making the leap from engineering samples to millions of units the core execution risk. The 3D silicon‑anode architecture adds manufacturing complexity that can pressure yields, quality, and unit costs during ramp, and any slip could jeopardize late‑2025 smartphone launch windows tied to customer qualifications. Investors must weigh the execution risk and potential for delays.

The company remains loss‑making with heavy cash burn as commercialization spending rises; in Q2‑2025, revenue was $7.5 million versus roughly $43.8 million in operating losses, underscoring the need for scale to improve margins and absorb fixed costs. The recent warrant exercise though has effectively dealt with liquidity concerns.

Initial revenue increases are likely to be concentrated on a few major contracts and some defense work. Delays on scale-up or matching customer needs can create volatility in share prices. I am using those, including the recent share price decline, to accumulate shares.

Opportunities: As the earlier part of the analysis covered, the total addressable market is exploding with a very long runway. The global energy storage market opportunity represents one of the most significant growth vectors in the technology sector.

The integration of AI functionality in smartphones and IoT devices creates a fundamental demand shift for higher-capacity, faster-charging batteries. AI processing requirements can increase power consumption by 2-3x compared to traditional smartphone usage patterns, making Enovix’s technology essential rather than optional. Their tech edge provides pricing power and leverage beyond traditional battery commodity dynamics.

Enovix’s US headquarters with Malaysian manufacturing provides strategic advantages in serving both Asian and Western markets while avoiding potential trade restrictions. The company’s technological independence from Chinese supply chain dependencies positions it favorably in the evolving geopolitical landscape. I believe they could acquire a battery facility in the U.S. soon, or joint-venture, or license, or some combination thereof.

Threats: As with any technology, the risk is something better coming along. I have no doubt that China will eventually steal the technology. QuantumScape’s (QS) and various Japanese solid state technology will likely be ready in the 2030s for commercialization.

As competition ramps, and if batteries with similar performance and safety parameters emerge, then margins could contract in the future.

Adoption by key players is important to Enovix and if that does not happen after all, then the company will be stuck with idle facilities. While I think that is unlikely, it is not a non-zero possibility.

3 Key Battery Markets

Smartphones: The smartphone battery market represents Enovix’s primary near-term commercialization opportunity, with the global market valued at approximately $45 billion in 2024 and projected growth to $65 billion by 2028.

Interestingly, a company we bought shares in a couple years ago, AST SpaceMobile (ASTS) is helping expand the smartphone market as they roll out satellite-direct-to-cell 4G/5G and voice capabilities.

The market is also undergoing fundamental transformation driven by AI-enabled device requirements, creating unprecedented demand for high-capacity, fast-charging battery solutions – as also noted above.

AI-enabled smartphones require significantly higher battery capacity to support on-device processing, advanced camera functionality, and always-on AI assistants. Enovix’s AI-1 platform directly addresses this requirement that is compatible with premium smartphone designs.

The transition to AI-enabled devices creates a natural market segmentation opportunity. Premium smartphones priced above $800 emphasize performance over cost, providing pricing power for advanced battery technologies. This segment represents approximately 300-400 million units annually, generating $15-20 billion in battery market value at premium pricing levels.

Enovix’s development agreements with two top-5 global smartphone manufacturers provide strategic market access and commercial validation. These partnerships target Q4 2025 commercial launches, positioning the company to capture early AI smartphone adoption waves. The agreements include customized battery specifications optimizing cycle life, charging speed, and energy density for specific device architectures. The OEM partnership approach reduces market entry risks, though replacing them with concentration risks.

I see smartphones as bringing the company to profitability relatively quickly.

EVs: I believe that the EV market represents Enovix’s most significant long-term growth opportunity, with the global EV battery market projected to reach $350 billion by 2030.

Silicon-anode batteries offer theoretical energy densities up to 10x higher than conventional graphite anodes, translating to extended driving range and reduced battery pack weight for electric vehicles.

Enovix’s constrained architecture addresses the silicon swelling challenges that have historically prevented automotive adoption, potentially enabling practical silicon-anode EV batteries. No more EV carrying ships catching fire.

The automotive market’s emphasis on safety, reliability, and performance over cost creates favorable conditions for premium battery technology adoption. EV manufacturers increasingly prioritize battery differentiation as a competitive advantage, supporting premium pricing for superior performance characteristics.

Energy Storage: As noted above, this is a massive TAM.

Grid-scale energy storage prioritizes cost, safety, and cycle life over energy density, potentially favoring different battery chemistries than consumer electronics applications. However, utility-scale applications increasingly require high-performance batteries for frequency regulation, peak shaving, and renewable integration services where energy density provides economic advantages. I believe that Enovix can fill the lithium-ion end of the energy storage equation.

Further, for use in industrial, commercial and residential properties for energy storage, the dramatically reduced fire risk is a game changer. At similar price points, again, even if energy density weren’t better, which it is, who wouldn’t buy the battery with lower fire risk?

Short Seller’s FUD Narratives

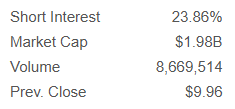

Short sellers have been pushing various narratives to support their short position. Currently, that short position is well over 20% of the available float.

Here’s the bullet points, which I have largely addressed above, both the bullish and bearish sides of the story:

- Manufacturing scale-up risk.

- Commercialization timing and potential delays.

- Cash burn and dilution.

- Customer/design-win risk.

- Competitive pressure.

- Overhanging bearish sentiment by frustrated investors.

- Commercialization challenges.

- Capital raise using warrants was smart but not enough.

- The innovation edge is overstated.

- AI opportunity overstated.

- General execution risk.

- “The Market” is forecasting disappointments.

I think legitimate short sellers have merit and value in the markets. However, in an age of social media, Reddit and trading rooms being able to amplify narratives to the point of making them self-fulfilling (I have an article about that coming), I think it is important to consider the motivations.

In the case of Enovix, I think shorts have used the time it takes for a company to ramp up, as a chance to tell stories, they may or not actually believe, to be able to help push the share price down of Enovix so they can win their trade.

My track record as an occasional short is pretty good compared to most shorts, I think the large short position can potentially fuel a short squeeze if Enovix announces OEM contracts anytime soon.

Enovix Financial Summary & Projections

These are taken from Enovix, several analysts and my own modeling. Do your own digging via research at your brokerages, Enovix filings and reporting. I think listening to Chairman Rogers is very enlightening.

Price Targets & Recommendations

- Average analyst price target: $19.81 (98.9% upside from $9.96 current price).

- Range: High of $33.00, Low of $9.50.

- TradingView consensus: $29.50 with max estimate of $100.00 (matches my 5-year price target).

- 10 analysts covering with Moderate Buy rating consensus.

Revenue Forecasts

I don’t care about 2025.

- 2026: $102M projected

- 2027: $378M projected

EPS Projections

- 2026: -$1.64 per share

- Long-term: +45.4% annual EPS growth expected

Actual Results & Company Guidance

- Gross margin: 31% (third consecutive quarter positive)

- Sequential revenue growth expected through 2025

Analyst Long-term Growth Forecasts

- Revenue growth: 42.2% annually

- Earnings growth: 43.8% annually

- “Hyper 260% growth pace” projected for 2026

- Revenue to exceed $2 billion by 2035 (6,000%+ total growth) – I think this could be substantially higher if EVs rebound. I think a billion+ by 2030 is very achievable.

Market Opportunity Sizing

- Smartphone battery TAM: $9B addressable (of $12B+ total)

- Top 8 OEMs represent 1B+ units annually – which should increase as 4G/5G expands reach to over 2 billion without it.

- AI-enabled devices driving 150x growth in power demand

Customer Pipeline

- 7 of top 8 smartphone OEMs receiving samples.

- Development agreements with two top-5 global OEMs as reported.

- UN38.3 certification completed for international shipping

Balance Sheet Strength

- $674M pro forma cash post-warrant exercise and convertible notes

- Current ratio: 4.68 which is excellent.

- Debt-to-equity: 0.83

Profitability Trajectory

- 5 consecutive quarters beating revenue guidance

- Operating expense reduction: 5% YoY in Q2 2025

- Path to EBITDA breakeven projected by 2027-2028

Enovix Technical Analysis

I use simple technical analysis and AI based algorithms. I don’t draw much anymore given how smart the machines are, but I do analyze different ways of looking at a stock’s sentiment as it is represented in price and volume.

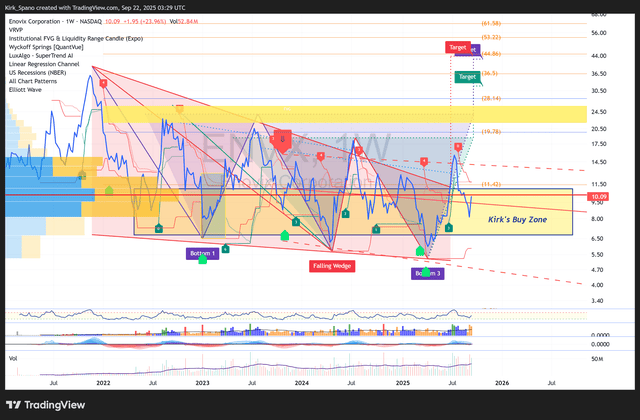

This is my recent chart on Enovix:

As you can see, I use a lot of indicators to see where there is confluence on the weekly time frames (not daily charts). The volume weighted bars on the far left indicate that the “Kirk’s Buy Zone” reflective of where buyers have come in repeatedly. It is a zone the price is in now – barely.

The built-in chart recognition algos have multiple price targets above $30 per share. Those technical projections roughly match with the growth I laid out above, that is, the market might indeed be seeing what I’m seeing.

A new Wyckoff Spring has not been displayed yet, but, I believe that is likely based on the Wyckoff volume below.

The institutional fair value gaps, essentially where institutions are pulling price towards, some call it a magnet, is in the middle $20s. In my experience, price almost always moves to and usually through those gaps.

The weekly RSI just turned up off a bottom. That is a good sign, though it often will double or triple bottom, so there could be a pullback in the short-term.

Theresa, one of our technical analysts, posted this recently:

She posted that essentially at the recent low, so, a very good call. She uses volume weighted supply and demand zone analysis similar to Wyckoff.

Enovix Investment Thoughts

I am building a full position in Enovix (ENVX). I currently have a starter position, but have also sold cash-secured puts (per our Monthly Options Expiration Update) to build the position to a full 4% of my and my investment firm’s client portfolios. For aggressive accounts, I can see building a double position.

The cash-secured puts have been very generous as shorts are bidding up the premiums. We have sold various strike price puts into October, November and December recently generating income and different potential net prices.

My intention this week is to buy any dips in price to get to a half position on share outright on the assumption some of the puts expire without assignment.

I do not take very high conviction positions often, but, as some of our winners of the past few years reveal, sometimes, we do very well. I think Enovix technology is a winner with a long runway, likely a decade or more. They have execution and timing risk, but, I’m not sure how much cheaper we can hope to get shares which have been coming off a recent bottom. I am building a position.