TJ Roberts Sep 8, 2025

Enovix has come such a long way, and now that way has just been lit with an additional ~$230M of raised cash of which $60M is for share buyback. Surely, TJ Rodgers, CEO Dr. Raj Talluri and the new CFO Ryan Benton had everything to do with that move, as well as naming the revolutionary silicon battery products as AI-1, AI-2 and AI-3. It’s like a repeat Apple Mac®OS evolution all over again, but Enovix’s evolution will be the cornerstone that hopefully your Apple’s, Samsung’s et al will eventually use to run their consumer electronics devices in the coming years.

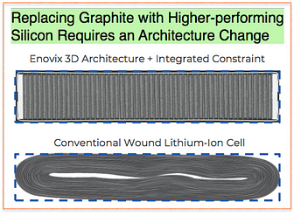

Enovix is sailing on the high seas with the Fab-2 build out on Penang Island and potential acquisitions, all on the horizon. With some additional HVM lines, Enovix could prove mass-scaling capability and then really attract some big fish. The 1st HVM line is estimated at 9M per year; the 2nd line is 12M. Companies like Samsung need 250–270M batteries per year in the consumer electronics arena, alone. Fab-2 is really just a model to prove to the rest of the world that silicon batteries for the consumer electronics world can be mass-scaled, and Enovix is going to be the first company to successfully do it with their revolutionary battery architecture.

Enovix hit 11% gross margin last quarter, albeit two quarters of GAAP losses at ~$23M and ~$43M, respectively. Even if they don’t hit their fabled 50% GM figure in Q4, at this point it doesn’t matter; they’re going to make it.

At 900–Watt-hours-per-liter, their battery almost doubles current lithium battery products on the market, which means a cell phones can stay powered on almost double what people are used to. But, the real advantage will be that cell phones will get more powerful in terms of AI functionality, so the battery hungry app’s will be able to run longer and perform the way they are intended. If Enovix eventually conquers the consumer electronics battery arena, that’s about 1.2 billion batteries annually. Godspeed!