Enovix creates a revolution in battery performance with only a seemingly small change in the process to make the batteries. Instead of laying whole electrode sheets on top of each other, they are diced in thin electrode strips and stood on their edge. But to date, manufacturing has been the Achilles heel of enovix and any investor in the space should know the history and I’ll try to connect the dots on where its headed. Just to level set everyone on manufacturing since its not something most American actually encounter anymore, you’re not trying to solve 1 or 2 really difficult problems. You’re trying to solve 1,000 tiny problems that all accumulate if you don’t get them under control. You want your engineers to be able to overwhelm the problems, not have the problems overwhelm your engineers.

watch this video to get a high level understanding of their mfg process

I won’t dwell too long on prior management. They did an exceptional job in inventing the product, and developing the strategy that is still mostly intact today. However, as I’ve said before, if you have a massive customer funnel, but your factory has a yield of 10%, all you really have are problems. As NorthVolt showed the world, just making regular batteries at high yield is exceptionally difficult even without any unique steps. And everyone has excuses, but Enovix was trying to ramp Fab 1 in Fremont in the middle of Covid meaning neither the machines nor the engineers supporting those machines could get to the factory. But 10% is 10% and clearly Enovix slipped coming out the gate. So TJ Rodgers took the bull by its horns and brought in Ajay Marathe as COO in Nov of 2022. He promised a different Fab that would be much lower cost and higher yield. By Jan of 2023 he hired Raj Talluri as CEO and he promised 4 lines up and running in a new fab by Q4 of 2024; aggressive to say the least. Given Ajay’s history in semiconductor manufacturing in Malaysia, in late march of ’23 they identified a location in Malaysia with a partnership with a company named YBS who was building a facility there. They had to facilitize the building for making batteries which involves creating clean rooms and dry rooms. In the fall of ’23 they purchased RouteJade in Korea which is a way to not just purchase an experienced battery maker with decades of process knowledge, this was how they purchased their coating/calendaring process to get the cathode and anode from powders into electrode roles. People think this is boring, but getting a proper electrode roll may be the most important step in the whole process. *The inability to do this is what held up Tesla’s in house 4680 line (albeit Tesla was trying to do so using dry processes, but the problem is still getting the electrode powders properly mixed onto a roll). During this time, Enovix also had to meticulously go step by step through the process and machines in fab 1, identify where yield was being lost, and start inching up the yield curve. Then they designed and ordered better machines, and went through factory acceptance testing (testing uph/yield at the machine making facility itself) and then SAT (bringing the industrial engineers from each supplier to your factory to sign off on operation when they see it running in conjunction with other machines). None of this is easy, nor fast, and you don’t pay the supplier until they pass or else you lose leverage. How do you eat an elephant? One bite at a time. During this process they were able to get yields at Fremont Fab 1 up to 60% from 10%. Not a number that is commercially viable, but a number that gave them the confidence they could hit world class yields and throughput north of 1350 units per hour with the proper facility and machines. They slogged their way through FAT and SAT for their agility line in Fab 2. They fell behind from their aggressive schedule during this process, but as Ajay stated, they were following FAT and SAT “like religion.” Importantly, Ajay stated in April of ’24 that zone 1, the laser patterning and stacking, was going exceptionally well and north of 90% for Zone 2 (stacking) serves as a report card for zone 1 so you know exactly how well its going.

(start listening at 7:40 for zone 1 and 2 FAT yields)

But nevertheless, by Spring of ’24 investors were still waiting on results. During the AMA in May of ’24, Raj explained that the biggest delay to the FAT process was actually zone 3A. This is where they do pre-lithiation which is a massive technical advantage for Enovix when using Si anodes. Raj says the machine supplier had a process that worked, but Enovix identified a much better process and held out to get this improved machine in place.

(listen at the 25 minute mark)

Despite the challenges, in August of 2024, as scheduled, they had their ribbon cutting grand opening for Fab 2 in Malaysia. This is where things start to get interesting. It gets interesting because long term Enovix investors were still under the TJ Rodgers 4 lines by end of Q4 in ’24 timeline, and were expecting Enovix would be rushing to get 4 lines up and running as fast as humanly possible. They also expected yields to already be nearing 90% for the whole process and if not to be the primary concern of the team. Ajay in the EC in August of 24, famously told investors, we would start the new facility where yields left off at fab 1, and improve from there. Investors lost their ___(minds). Plus Raj wanted to buy a home in the bay area with stock adding to the investor disdain. Instead of the aggressive 4 lines by end of ’24 timeline, the team has clearly made the call to focus on strategically proving out one line. Investors have punished the stock for this approach, but I think without question this was the right call, and the promised land is now finally near. Let me explain why….

During their grand opening in August of ’24, prospective customers visited. According to a fireside chat with William Blair in Sept of ’24, one such customer told Raj, “I’ve never seen that before.” Meaning they had never seen a battery factory go from nothing to something that fast. While investors clearly wanted to see it move much faster, true industry insiders were quite impressed. Moreover, in the same chat Raj indicated that the same customer was very interested in a ~7,000 mAh capacity cell for their phone. By all appearances, this customer is the one that followed through and signed a deal in October for a development agreement with mass production starting in late 2025. This was now the primary cell phone customer for Enovix and the most important deal to date, but it came with a very detailed milestone and qualification process that would take the better part of ’25. Rather than chase 4 lines for the sake of 4 lines, or chase yield for the sake of yield, the focus went to keeping this customer (plus the multiple smart eyeglasses customers) happy, proving out the first high volume line, and reducing capex for the rapid follow on lines once the first line is proven and this customer goes from agreement to full on purchase order in a phone model; all while not running out of money. This strategy is most clearly outlined in the Oppenheimer fireside chat in November. They explained in both the Q3 ’24 EC and in the fireside chat that they had time to the full ramp in late ’25 (which likely upset impatient investors who wanted lines, yields, and uph now….not “we have time”) and they were going to use that time to cost reduce future versions of the line. Yields were near 80% in Nov and thus they had time to ramp the yields from ~80% to 90% in ’25 while working with their suppliers to cost reduce machines for new lines. In this call they say, “for example, cutting electrodes we can do them much quicker” (related to new technology coming…likely newer lasers and laser software) and “so we can have all the dicing in one farm, and all the formation in one farm (zone 4), and we optimize in the middle.” Raj also says, “So it’s an optimization of a well understood process stage at a time to take advantage of the cost reduction that the mechanical engineering team has come up with and also the material advancements are coming up” (*silicon carbon anodes for EX2M are easier to dice than silicon oxides for EX1M). So it’s clear to me now that while investors want to hear nothing but yield numbers, Raj wanted a disciplined approach that maximized capital efficiency while hitting the yield improvements over a mfg roadmap that would take most of ’25 but was directly connected to the year-end ramp with the newly signed deal. Since that time, what has happened in terms of mfg? They completed SAT on the high volume line at the end of ’24 at a rate of 1,350 UPH. They completed multiple audits including 3rd party ISO audits and multiple customer mfg audits, one of which was likely a milestone in the key agreement getting them the exact dimensions of the cell phone battery. They have now reiterated multiple times in EC’s that in each qtr in ’25 they have hit critical yield improvements, which tells me they are on schedule to their mfg roadmap created in Oct of ’24. Given this history, and what I view as their approach since getting their landmark cellphone order, when Enovix says in the Q1, 2025 investor letter from April 30, 2025, “We see a clear path to execute against our manufacturing roadmap” and Ajay in the call says, “We have made a lot of good improvement on yields and we definitely stand by our statement that we will be up on the yields as the ramp production really begins to world class levels”; I see this as a team executing to plan. However, investors think the plan is purely UPH and yield numbers given their anxiety from Fab 1, while the team on the ground is focusing on those metrics in a more disciplined way, while also focusing on capital efficiency. To be frank, to those who have not manufactured, you cannot hit world class yield numbers in complex manufacturing unless you stop everything else and just run one line on one exact specification the exact same way with no changes for an extended period of time. And it just doesn’t make sense to do that until you need to to fill orders, unless you are terrified that it truly cannot be done.

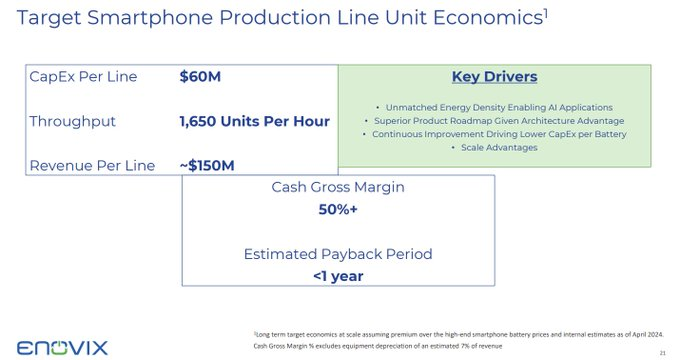

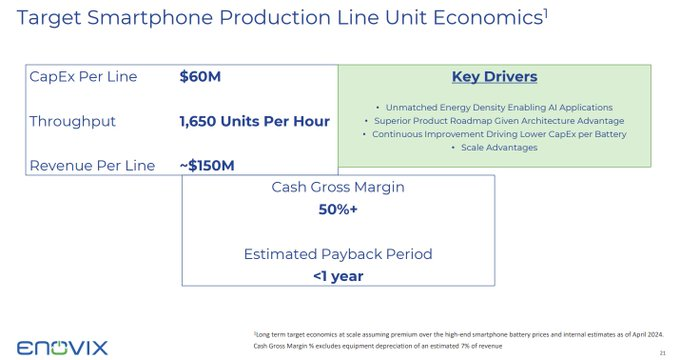

We’re heading into the home stretch, but I want to share WHY I would rather have 1 line done right, than 8 suboptimal lines even if they were up and running at this point in time. When I started this post, I stated that mfg is about solving 1,000 small problems all at once and repeatedly. NorthVolt went bankrupt in part because they added too many lines too fast. Instead of 1,000 problems, they had 10’s of thousands of problems and the problems overwhelmed the engineers not the engineers overwhelming the problems. By focusing on proving out 1 line the right way Enovix is in a position where the engineers can overwhelm the problems. Moreover, by buying RouteJade, Enovix eliminated the entire first half of the battery making problem-set (coating electrodes) while increasing their overall engineering knowledge. By taking this disciplined and capital efficient approach to hitting the fab 2 ramp up of their marquee customer, enovix is making the attached slide more likely to happen. This slide is effectively my investment thesis, if they can hit anywhere close to these numbers (less than a 1 yr payback per line) when they are at scale, this slide means they have invented a money printing machine not just a battery making process. So I am much more concerned with the probability that these numbers can be achieved, then the timing of it all. Additionally, in negotiations if you build out too many lines at once, the customer now knows you need them to fill excess capacity more than they need you. You have to walk a delicate balance where the customer believes you can satisfy their demand if they order, but if they want to get a piece of your limited capacity, they will have to sign the deal now and at terms that are favorable to you. Raj would have learned this lesson well while negotiating at Mircron. All this being said, being delayed does have consequences. In fact, if you panic, it could be a death sentence where you run out of money and confidence. Fortunately, Raj seems to be a steady hand at the wheel and TJ is as steadfast as ever. The first consequence of delay is that others catch up. And Si carbon doped batteries with silicon from Group 14, Sila Nano, Nexeon, and their Chinese non-named equivalents have now entered the scene offering about a 15% energy density increase to prior versions of cell phone batteries. This puts EX 1M in a position where it likely has to compete on cost, though impressive that even with outdated silicon oxide is competitive. Fortunately, the team has continued their R&D roadmaps and EX-2M has already had samples shipped and ready to be ordered and EX-3M engineering samples will ship this yr. Managing to increase R&D, cut overhead, all during this extreme mfg transition is quite frankly a small miracle. Other good news, during this mfg delay other tailwinds have picked up. The thesis that AI will come to the edge and that will mean that phones need more space for chips while simultaneously requiring more battery capacity is playing out perfectly. The smart eyeglasses MR market has moved from a cool curiosity to a massive business opportunity with Enovix in the lead. RouteJade may actually be a significant revenue add itself and not just a coating operation, and in the much wider battery market the billions invested in the cylindrical form factor are being put under pressure and may need a change to survive, creating a serious potential future opportunity even beyond the 20 billion consumer electronic opportunity.

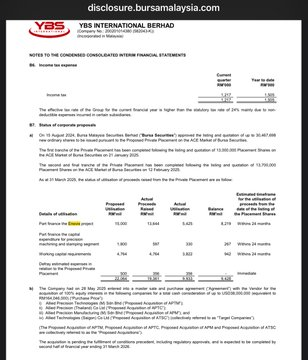

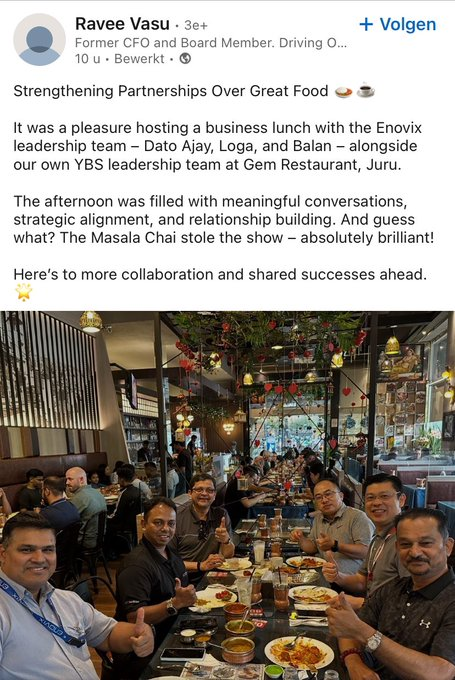

Now I couldn’t tell this story without also telling the relationship with YBS story. As you recall, YBS is the fab2 mfg partner/landlord. They are the landlord and also the ones to provide the operator staffing on the line as well as some of the tooling. While YBS was essential to getting a facility ready for launch so quickly after deciding where it would be, I think YBS thought the ribbon cutting ceremony in August of ’24 would result in immediate profit. Given where the lines were actually at in Aug, this was not possible and 1 week before the opening ceremony, YBS CEO had a wild podcast. The theme of that podcast was essentially this, battery mfg is hard (no kidding), and YBS has other options if this doesn’t work out. If you were a swing trader, that was the time to sell and the 2024 high water mark was the release date of that podcast. Then since that time, Enovix renegotiated their deal with YBS in October. It was unclear if this re-negotiation was seen as mutually beneficial or antagonistic or what exactly was happening. Enovix claimed this allowed them to avoid having to report as a Variable Interest Entity, which is probably true, but nevetheless concerns remained. Fortunately, in recent months the two parties now seem aligned once more. YBS mentioned an Enovix project in their last EC which is very comforting to see. Also, there was LinkedIn Post where and Ajay and Team sat down with YBS leadership “filled with meaningful conversations, strategic alignment, and relationship building.” IDK if there ever truly was a problem to begin with between the two, no one ever spilled the tea which is a good sign, but if there was an issue the two partners seem to be in a much better place now. To make mfg work you need the parts, the people, the processes, and the machines to be all working together. Glad to see it coming together here.

In summary, the mfg journey for Enovix has been a wild ride. It was the Achilles heel that brought them down out the gates. Investors are understandably highly anxious. While behind their initial schedule, I see the Enovix team as currently working to a disciplined mfg roadmap that is aligned with signed deals and qualification schedules, and this disciplined approach will make the probability that they can hit the numbers listed in the attached slide more likely. If they can do that, the wait will be worth the agony. If they can do that, Enovix will go down as one of the greatest comeback stories in American business history. But to be clear, this is yet to be proven. I see the strategy, but like all the other investors, I too just want to hear UPH and line yield numbers myself. Hopefully we’ll get some more details soon. Grab your popcorn and good luck out there.