Summary

- SoundHound AI has eviscerated its disbelievers, notching a gain surpassing 900% over the past one year.

- The company is leading the game in Voice AI, a segment potentially too small for big tech to scale into at the moment.

- Still, the competitive landscape in Voice AI is far from established, and SoundHound’s position is tenuous at best.

- Moving into profitability by the end of 2025 should help keep buyers onside, while it works to scale into more enterprise verticals.

- I argue why this isn’t the time for you to jump on the SOUN bandwagon now, unless you want to lose your money.

- I am JR research, an opportunistic investor who identifies attractive risk/reward opportunities supported by robust price action to potentially generate alpha well above the S&P 500. I run the investing group Ultimate Growth Investing.

As a growth and tech investor, I’ve written about many AI stocks over the past year, as it has probably become one of the most important (if not the most important) innovations of all time. Not only does it have the potential to become the fourth industrial revolution, it has already upended things like climate tech funding (because we need ever more energy for AI data centers!), while also helped nuclear energy emerge from a “dormancy” as big tech searches for multiple sources of energy to power increasingly massive AI clusters (reaching into the 1M GPUs size and possibly more moving forward).

Without a doubt, AI has dominated 2024, and I believe it will continue to dominate 2025 as well, as I indicated in my recent market outlook article and my top five tech stocks play for this year. While I only intend to share my preferred buy levels and portfolio picks with my subscribers in Ultimate Growth Investing, I also believe in providing insights to readers to do further due diligence into their stocks. Therefore, even though I don’t own SoundHound AI (NASDAQ:SOUN) in my personal portfolio, I still find it interesting in how an unprofitable company that competes as a pure-play Voice AI competitor has garnered such loyalty among its buyers that saw the stock gained more than 900% over the past year, much of it arguably in the last six months.

If you are new to SoundHound, I encourage you to refer to the series of updates that I’ve written about the Conversational AI company, and how SOUN’s business model works. Of worthy mention, I indicated in my most recent SOUN article in November that the monster move wasn’t over yet, as the company has showcased its ambitions and ability to expand into more monetizable industry verticals. SOUN buyers loaded up with such high conviction that allowed my thesis to play out much faster than I had anticipated. With a 62% public ownership, it seems like retail investors have rushed in to catch the SoundHound AI gravy train, as it left the station in a hurry. If you didn’t catch that move, I’m sorry, but I think you might want to consider taking a step back and reassess your options more carefully. Why?

I don’t want to sound repetitive here, but valuations concerning AI and tech plays have triggered some yellow flags in me, as I enunciated in the tech outlook article. Hence, feverish attitudes and perhaps more “cavalier” posture toward considering valuations seem to have seeped into investor sentiments recently, as we can observe from SOUN’s price action (more on that later). At the same time, SoundHound AI bulls could point out that the company’s proprietary AI technologies and penetration into more enterprise verticals beyond its core automotive verticals corroborate a broader adoption of its stack, and validate the usefulness of its thesis in several applications. Management’s thesis on this has consistently been underpinned by what it believes is a TAM worth $140B. If we consider SoundHound’s FY2024 projected revenue of just under $85M, we can deduce that the company has merely scratched the surface of a massive market opportunity.

Competition is intense in Conversational AI, consisting of big tech and also the pure-players like SoundHound. We also witnessed at the end of last week just how buoyant the Voice AI opportunity has become, as Nvidia (NVDA) is reportedly working with Cerence AI (CRNC) to further develop its Voice AI capabilities. I believe there are sufficient reasons for us to be optimistic. SOUN burnished its credentials as having working on its model for 20 years, and accumulated a treasure trove of highly valuable data. In addition, it also makes sense for big tech to focus on more highly scalable opportunities to monetize AI, and may not be interested in targeting nascent industries like Voice AI, as they may not move the needle on their operating performance in the near term. Hence, while the threat from deep-pocketed big tech could be a bigger concern subsequently, the runway for SoundHound to expand its industry-specific applications seem clear for now.

SoundHound’s products also reportedly offer a higher accuracy (up to 95%), driving more confidence in the robustness of its models. It makes a lot of sense for enterprise customers to be wary about the hallucination potential of Generative AI when seeking to deploy Agentic AI in their customer service processes, due to the significant reputational and credibility impact. However, we also shouldn’t discount the possibilities that AI companies might view the increasingly lucrative openings created by SoundHound and its Voice AI peers in creating more diverse monetization themes. In other words, I think the competitive landscape in Voice AI is far from certain, underscoring the need for SoundHound to move quickly into profitability to validate the sustainability of its business model and gain a critical edge over its rivals.

SoundHound’s net cash balance sheet with $136M in cash and equivalents is a favorable metric. Although the company is still expected to reported negative free cash flow of $55M in FY2025, it’s probably not going to cause significant worries to investors as management maintained its confidence in reaching adjusted EBITDA profitability by the end of the year. If it all works out, it seems to suggest lower inference costs moving ahead, which should also pave the way for SOUN to scale its edge-based models more efficaciously, while it attempts to gain access into more industry segments.

Well, the thing is, I don’t think the market hasn’t recognized the growth potential for SoundHound AI. Clearly, with a forward revenue multiple of almost 90x (on enterprise value), euphoria is running high. We don’t have viable earnings-based valuation metrics to assess SOUN’s thesis yet, as the company is still unprofitable. However, I don’t think it’s a misnomer to determine that speculative fervor on the stock is increasingly hard to justify, as the competitive landscape remains far from certain. Do we really want to keep chasing this stock much higher, while assuming that big tech and other AI companies aren’t aware of the burgeoning opportunity?

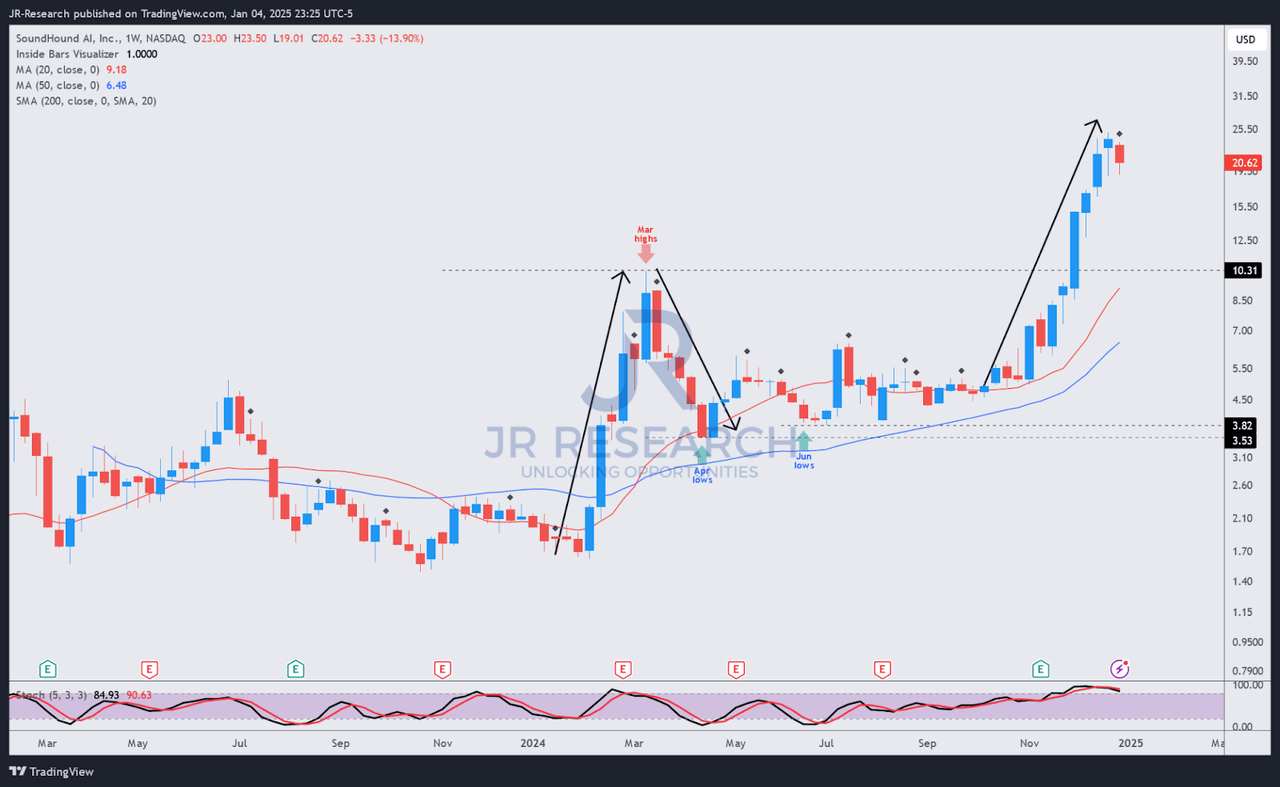

Timing an entry into SOUN isn’t straightforward due to the stock’s incredible volatility. Clearly, investors who chased the stock to its previous tops were hit by sharp downward moves, as profit-taking digested the previous bubbles that built up. Of notable mention is the previous peak in March 2024 as the stock fell steeply before dip-buyers came back in April.

Yet, strong support above the stock’s $4 level likely provided more confidence for buyers to keep accumulating before the spectacular rise through its December highs. Short interest ratio on SOUN remains close to the 25% level, indicating that bearish investors have not given up, despite likely facing some pain if they loaded up on their short positions before the rise in the last few months.

My view is that turning bearish right now doesn’t seem to be the right move, as the company seems to be getting close to reaching profitability on an adjusted EBITDA and FCF basis. Also, investor sentiments driving AI should continue to be constructive for stocks with AI imprinted on their thesis, and SOUN is a pure-play in the Voice AI aspect. The stock’s price action also suggests while profit-taking looks to be in the works, the overall trend bias is still skewing bullish, and it aligns with the positive momentum in AI plays. However, I think the risk/reward has turned more balanced for now, as the stock should consolidate while earlier investors reassess whether its high valuation is still reasonable.

Rating: Downgrade to Hold.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.